IC Markets is a top-tier online trading platform and broker known among active traders as some of the most competitive commissions and spreads. Raw IC Market Spreads as low as from 0 pips. IC Markets pride itself on super fast 40 milliseconds order execution speeds, which process over $15 Billion or around £10 billion Sterling pounds in daily trades. IC Markets are one of the few brokers that can say they offer an institutional-grade trading platform.

We have done an extensive review of the company and found it legit and recommendable. This broker provides maximum flexibility on deposit and withdrawal requirements for all traders.

At FXCracked.com, we have a readers-first policy. Thus, we always put our readers’ safety as a priority in our business line. We will never satisfy ourselves with brokers’ public information, however, go in-depth. Often we will also open live and demo accounts and test brokers directly.

What Makes IC Markets a Leading Forex Broker?

IC Markets is a forex and CFD broker founded in 2007 and based in Sydney, Australia. They offer trading solutions for active day traders, scalpers, and those new to the forex market. The broker provides a wide range of trading instruments, including forex, commodities, indices, cryptocurrencies, stocks, and futures. IC Markets has built a strong reputation among traders worldwide.

Is IC Markets Safe? A Complete Review of Regulations and Security

IC Markets is a legitimate and safe broker. IC Markets is not publicly traded and does not operate a bank. IC Markets is authorised by two Tier-1 regulators (high trust), zero Tier-2 regulators (average trust), zero Tier-3 regulators (Average Risk), and three Tier-4 regulators (High Risk).

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Seychelles Financial Services Authority (FSA)

Client funds are held in segregated accounts with top-tier banks, ensuring the security of trader assets.

How Are You Protected?

IC Markets adheres to regulations that require the segregation of client funds, negative balance protection, and compliance with internal risk management protocols. This provides a secure trading environment for all clients.

Regulation and Licenses

IC Markets operates under stringent regulatory standards enforced by:

- ASIC: Ensures adherence to strict financial practices.

- CySEC: Provides regulatory oversight for European clients.

- FSA: Covers clients from other regions.

What Leverage Do They Offer?

IC Markets offers varying leverage levels depending on the regulatory jurisdiction:

- ASIC (Australia): Up to 1:500

- CySEC (Europe): Up to 1:30, in line with ESMA regulations

- FSA (International): Up to 1:1000

Leverage allows traders to control larger positions with a smaller initial margin, but it also increases potential risks.

1:100 leverage is the sweet spot for balancing risk and reward, and IC Markets offers this leverage except for clients in Europe.

IC Markets Trading Platforms: MetaTrader, cTrader, and More

IC Markets has strengthened its position as an excellent choice for algorithmic traders thanks to the availability of the MetaTrader, cTrader, and TradingView platforms. IC Markets also delivers robust execution methods (i.e., no requotes) and the ability to place orders within the spread.

IC Markets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) from MetaQuotes Software Corp., and cTrader from Spotware Systems. MetaTrader clients can also access the Advanced Trading Tools package for the desktop version, as well as plugins from Autochartist and Trading Central. These third-party plugins must be installed separately, but they significantly enhance the MetaTrader experience. Additionally, IC Markets recently introduced the popular TradingView platform, available for both desktop and web, supporting algorithmic trading and backtesting.

Find the best platform for your trading needs. Try IC Markets with a free demo account now!

1. MetaTrader 4 (MT4)

- User-friendly interface

- Advanced charting tools

- Automated trading through Expert Advisors (EAs)

- Wide range of indicators

2. MetaTrader 5 (MT5)

- Improved charting tools and order management

- Additional timeframes

- Economic calendar integration

3. cTrader

- Intuitive design

- Enhanced charting tools

- Innovative order management systems

Mobile Trading

All three platforms are available as mobile apps for iOS and Android., ensuring traders can manage their accounts and execute trades on the go.

Tools comparison: The MetaTrader, cTrader, and TradingView mobile apps offer comparable functionality and charting features. Your choice of platform will likely depend on whether you trade manually or rely on desktop platforms for automated trading systems.

Algorithmic trading: Automated trading isn’t available on the mobile versions of cTrader, MetaTrader, or TradingView. These mobile apps are mainly useful for managing existing positions or manually opening new trades. Mobile copy trading is supported through third-party platforms like ZuluTrade and IC Social (powered by Pelican).

Other Benefits from Trading Platforms

Charting: MetaTrader and cTrader provide excellent charting with a wide range of default indicators and an even larger selection available from third-party providers. IC Markets offers both web-based and desktop versions of cTrader. TradingView is also renowned for its Supercharts.

MetaTrader Tools: IC Markets includes the Advanced Trading Tools package, a suite of platform add-ons developed by FX Blue. It also offers third-party plugins from Trading Central and Autochartist.

Algorithmic Trading: The desktop version of MetaTrader supports algorithmic trading, and cTrader includes applications such as cAlgo for automated trading and cTrader Copy for social copy trading. IC Markets is popular with serious algorithmic traders due to its low cost and execution methods, as well as support for Virtual Private Servers (VPS). TradingView also supports backtesting and algorithmic trading on both its desktop and web apps.

VPS Services: IC Markets offers several free third-party VPS services for hosting client algorithms to traders who complete at least 15 standard lots.

Social Copy Trading: Besides cTrader Copy and the native Signals market from MetaTrader, IC Markets supports copy trading via Myfxbook (AutoTrade) and ZuluTrade across its global brands. Recently, IC Markets launched IC Social, a mobile-only app powered by Pelican Exchange, available in select regions through IC Markets’ Seychelles entity.

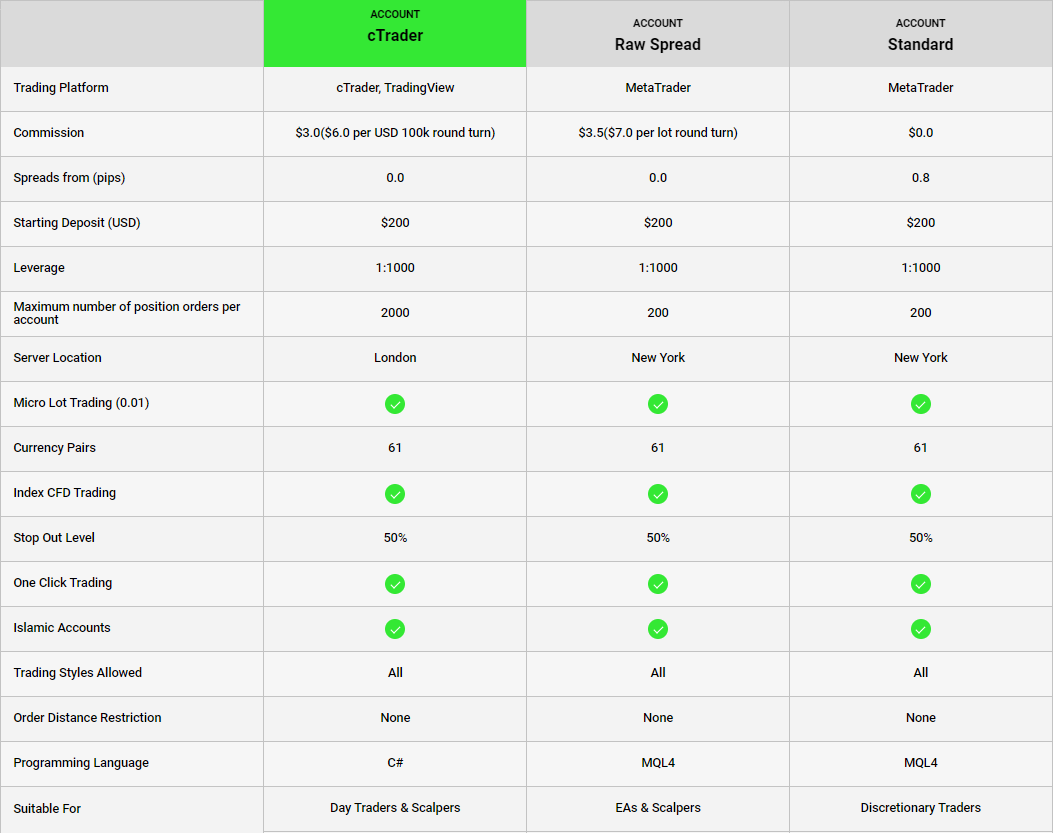

Account Types

IC Markets provides three main account types to cater to different trading needs:

Standard Account:

- No commissions.

- Spreads starting from 1 pip.

Raw Spread Account:

- Spreads from 0.0 pips.

- $3.50 commission per lot (per side).

cTrader Raw Spread Account:

- Spreads from 0.0 pips.

- $3.00 commission per lot (per side).

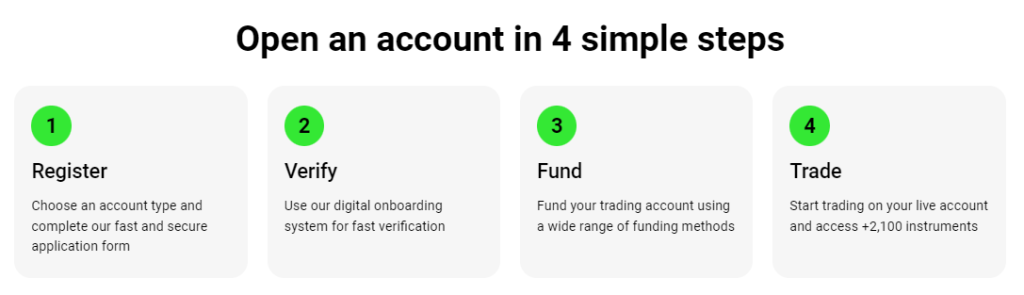

Step-by-Step Guide: How to Open an IC Markets Account

Opening an account with IC Markets is straightforward. The process involves:

- Registration: Complete the online form.

- Verification: Submit identification documents.

- Funding: Deposit funds using various payment methods.

Ready to start trading? Open an IC Markets account today and experience top-tier Forex trading!

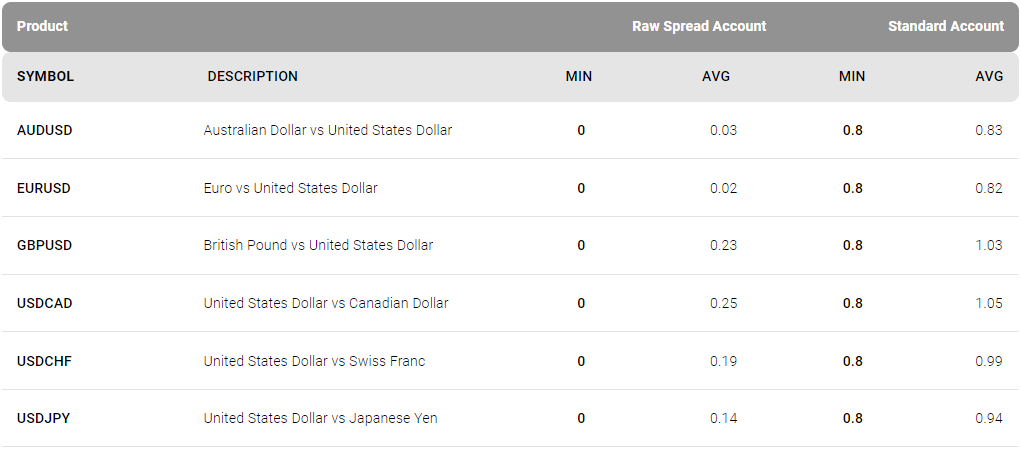

Spreads and Commissions

IC Markets is known for its competitive trading costs:

- Spreads: From 0.0 pips on Raw Spread Accounts.

- Commissions: $3.50 per lot per side on Raw Spread Accounts, $3.00 on cTrader Raw Spread Accounts.

Spreads at IC Markets vary depending on the trading platform you use, your account type, and your chosen IC Markets entity. IC Markets has three regulatory entities available: European (based in Cyprus), Australian, or its offshore entity based in Seychelles.

Account types: IC Markets offers three account options: the commission-free Standard account (spread only), and the commission-based Raw Spread and cTrader Raw Spread accounts.

cTrader vs. MetaTrader accounts: The cTrader Raw Spread account and the IC Markets Raw Spread accounts for MT4 or MT5 have almost identical commission structures. The main difference lies in the platform choice. The cTrader account has a slightly lower commission of $3.00 per side for every 100,000 units traded, or $6.00 per round turn. In contrast, the Raw Spread account using MT4 or MT5 charges $3.50 per side for every 100,000 units, totaling $7.00 per round turn.

Effective spreads: In August 2022, IC Markets reported an average spread of 0.02 pips on the EUR/USD pair. Including the cTrader account’s commission, equivalent to 0.6 pips, the total cost is 0.62 pips. For the MetaTrader Raw Spread account, this total cost rises to 0.72 pips. Both are competitive rates. The Standard account, with an average spread of 0.62 pips and no commission, is also an appealing option.

Discounts: IC Markets provides discounts for traders who exceed 100 standard lots in monthly trading volume.

Agency and dealer execution: IC Markets operates on an agency basis, meaning orders can experience positive or negative slippage, with no requotes or instant execution. Despite this, IC Markets also acts as a dealer and counterparty to trades. While it routes orders to nearly two dozen liquidity providers, it doesn’t hedge all trades and manages some risk internally as a dealing desk.

Trading Instruments

IC Markets offers a total of 3,583 tradeable instruments across its Australian, Cyprus, and Seychelles-based entities. The table below summarizes the different investment products available to IC Markets clients.

- Forex: 60+ currency pairs.

- Commodities: Gold, silver, oil, and natural gas.

- Indices: Major global indices.

- Cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

- Stocks: Access to various global stocks.

- Futures: Different futures contracts.

Cryptocurrency: Cryptocurrency trading is available at IC Markets through CFDs, but not available through trading the underlying asset (e.g. buying Bitcoin).

#table

Deposits and Withdrawals

IC Markets supports multiple funding options:

Deposit Methods

- Bank transfers

- Credit/debit cards

- E-wallets (PayPal, Skrill, Neteller)

Withdrawal Methods

Withdrawals are processed within 24 hours and can be made through the same methods as deposits.

Customer Support

IC Markets provides excellent customer service available 24/7 via:

- Live Chat

- Email Support

- Phone Support

Education and Resources

IC Markets offers extensive educational resources:

- Webinars and video tutorials

- Comprehensive articles and guides

- Economic calendar

- Technical analysis tools

IC Markets offers a solid range of content for both beginners and advanced traders, with over 100 written articles and numerous videos. However, the content isn’t organized by experience level, and it lacks progress tracking and quizzes, features that are often found with the top forex brokers for beginners.

IC Markets educational content is divided into six series, including Forex Trading 101 and Trading Plan 101. The quality of these articles is slightly above the industry average. Additionally, IC Markets has a podcast series called “IC Your Trade” and a YouTube channel with a collection of archived webinars.

IC Markets could enhance its educational offerings by developing courses with progress tracking and quizzes and adding filters to sort content by experience level. Expanding the number of available learning materials would also be a welcome improvement.

Market Analysis

IC Markets is enhancing its research content, especially through its evolving IC Your Trade series, which includes high-quality videos and articles.

IC Markets publishes multiple articles daily on its blog, featuring technical and fundamental forecasts. While the research quality is decent, it doesn’t quite match up to industry leaders like IG and Saxo. However, it’s noteworthy that the content quality has been improving each year, including the IC Your Trade podcast series.

IC Markets provides in-house technical and fundamental analysis on its blog and offers daily updates in its market analysis section. The platform includes videos from Trading Central, short clips recapping market events in the Web TV section, and live trading sessions on the IC Markets YouTube channel.

IC Markets Pros and Cons

| PROS | CONS |

|---|---|

| IC Markets maintains regulatory status in two Tier-1 jurisdictions and three Tier-4 jurisdictions. | Trails the top forex brokers when it comes to its scope of market research and the quality of its educational content. |

| Third-party research and trading tool plugins helped IC Markets win our 2024 Annual Award for #1 MetaTrader broker. | Lacks a proprietary forex trading app. |

| Competitive pricing and low average spreads are available across all account types. | Share trading is limited to AU stocks for Australian traders, available via the broker’s IC Shares offering. |

| IC Markets’ multi-platform offering also includes MetaTrader 5, cTrader, and TradingView, making it a great choice for algorithmic trading. | |

| IC Markets’ scalable execution makes it a perfect fit for traders who want to run algorithmic strategies. | |

| Range of markets has significantly expanded to more than 3,500 symbols. | |

| Research and educational content has been improved with the addition of new video series and blog articles. | |

| Traders looking for copy trading platforms will appreciate the IC Social mobile app (powered by Pelican Exchange) as well as the newly launched Signal Start platform. |

Conclusion

IC Markets is a top-tier broker offering a robust trading environment with competitive spreads, fast execution speeds, and multiple trading platforms. Its strong regulatory framework and comprehensive customer support make it a reliable choice for traders of all levels. Whether you are a novice or an experienced trader, IC Markets provides the tools and resources necessary for successful trading.

Join over 200,000 traders using IC Markets! Visit the official website to explore your options.

Final thoughts & FAQ

IC Markets is a popular choice for algorithmic traders using MT4, MT5, or cTrader platforms due to its fast execution, competitive spreads, and low commissions.

With servers in New York (Equinix NY4) and London (Equinix LD5), IC Markets is ideal for scalpers and high-frequency algorithmic traders needing low latency and quick execution.

By focusing on high-frequency traders, IC Markets achieves higher trading volumes compared to its competitors, as automated trading strategies typically generate more trades than manual ones. This focus helped IC Markets win first place in the MetaTrader and Algo Trading categories in 2024.

In June 2023, IC Markets’ monthly trading volume exceeded $1.39 trillion, serving over 200,000 clients across its brands (IC Markets and IC Trading). According to its Wikipedia page, IC Markets employs 260 people.

Access to third-party social trading services like Myfxbook and ZuluTrade makes IC Markets appealing to retail forex and CFD traders. This helped IC Markets earn top honors in Social Copy Trading and the Commissions & Fees categories. We generally do not recommend IC Markets unless you are an algorithmic trader or if your manual trading strategy is sensitive to spreads.

Is IC Markets a Good Broker?

IC Markets is a great broker for investors who want to use automated trading strategies on MetaTrader and cTrader platforms. IC Markets offers social copy trading services, a growing range of research and educational materials, and competitive pricing.

Is My Money Safe With IC Markets?

IC Markets is regulated in Australia, Cyprus, the Bahamas, the Seychelles, and Mauritius. The safety of your funds depends on which entity holds them.

For example, in Australia, the National Guarantee Fund doesn’t offer protection when trading CFDs. However, IC Markets in Australia is regulated by ASIC, has indemnity insurance, and keeps your funds in a Client Moneys Trust Account. In Cyprus, the Investors Compensation Fund can protect eligible retail clients up to 20,000 euros per account with IC Markets EU in case of bankruptcy.

The IC Markets entities in the Bahamas, the Seychelles, and Mauritius provide fewer regulatory protections.

Founded in 2007, IC Markets’ long operation and various regulatory licenses are important factors when choosing a broker. Choosing a well-capitalized broker like IC Markets also reduces potential counterparty risk.

What is the Minimum Deposit for IC Markets?

The minimum deposit at IC Markets is $200 to open a live account, no matter which account type you choose, including Standard, Raw, and cTrader options. There are many ways to fund your account, such as bank transfers, credit cards, and third-party payment providers. Traders can also use PayPal to fund their IC Markets account.

Our Review Methodology

At FXCracked.com, our reviews of online forex brokers and their products and services are meticulously crafted based on comprehensive data and the expert insights of our seasoned researchers. Annually, we publish extensive research on the leading forex brokers, monitoring numerous international regulatory bodies (learn more about our Trust Score methodology here).

Our dedicated research team rigorously tests a wide array of features, products, services, and tools, meticulously gathering and validating thousands of data points. We evaluate all trading platforms offered by each broker, whether proprietary or from third-party providers, and assess them based on numerous data-driven criteria.

We delve deeply into each broker’s commissions and fees, including bid/ask spreads and average spread data for popular forex currency pairs. We also analyze other trading costs such as inactivity or custody fees, minimum deposit requirements, VIP rebates and discounts, and various other critical fee-based metrics.

Additionally, our research encompasses key categories such as mobile trading accessibility and capability, the availability of market research and educational content, and the overall Trust Score for each broker.

CFD Risk Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forex Risk Disclaimer

Trading securities carries a high level of risk. This is especially true for margin-based forex trading, off-exchange derivatives, and cryptocurrencies. Risks include leverage, creditworthiness, limited regulatory protection, and market volatility, which can significantly impact the price or liquidity of a currency or related instrument. There is no guarantee that the methods, techniques, or indicators discussed in these products will be profitable or prevent losses.