Table of Contents

Introduction

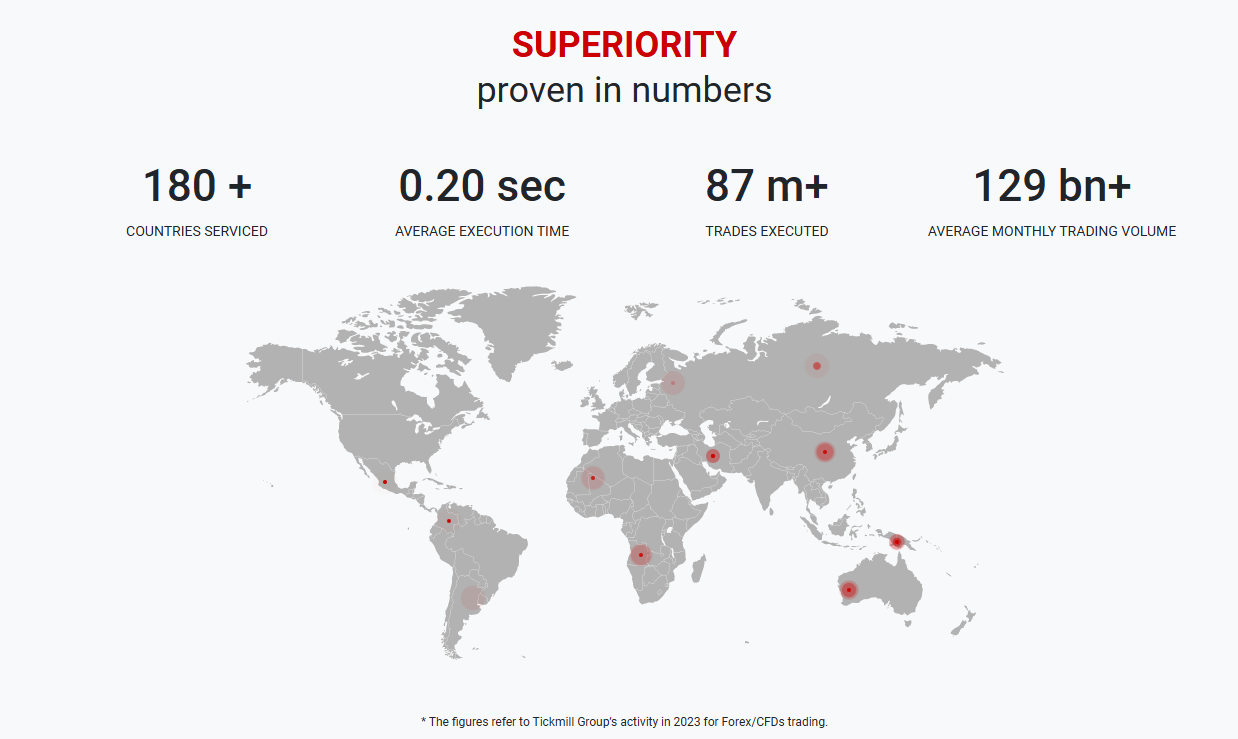

The online trading landscape is brimming with brokers, each claiming to offer top-tier services, low trading costs, and exceptional execution quality. In this crowded marketplace, Tickmill has carved out a reputation as a reliable and cost-effective broker, drawing in both novice traders and seasoned professionals. With regulatory oversight from respected authorities and a global presence that spans multiple continents, Tickmill aims to deliver trading conditions that stand out in terms of transparency, security, and pricing efficiency.

This comprehensive Tickmill review serves as a complete resource for potential clients. We will thoroughly cover the company’s background, regulatory environment, trading platforms, product offerings, and fee structures. Additionally, we will delve deep into its execution speed, order processing capabilities, customer support responsiveness, and the educational ecosystem that sets Tickmill apart as a broker that wants its clients to thrive. By the end of this guide, you will have a nuanced understanding of whether Tickmill aligns with your personal trading strategies, risk tolerance, and long-term investing goals.

Company Background and History

Tickmill’s story began in 2014, but its roots extend further back through a team of industry veterans who had accumulated significant experience in trading, fintech innovation, and brokerage operations. The founders identified a need for a broker that would prioritize transparency, fair pricing, and direct market access. Early on, the company’s focus was to create a trading environment that empowers clients with professional-grade conditions traditionally reserved for institutional players.

Over the years, Tickmill expanded its product range from primarily focusing on forex to including CFDs on commodities, indices, bonds, and more. This expansion was driven by client demand, as traders sought a one-stop brokerage solution for all their investment needs. Each phase of growth was accompanied by improvements in technology infrastructure, partnerships with top-tier liquidity providers, and the acquisition of critical licenses in reputable financial jurisdictions.

Today, Tickmill’s brand presence is felt worldwide. The broker’s offices in various global financial hubs and its multilingual customer support help ensure that clients receive localized, user-friendly services. This combination of a global footprint and a deep understanding of local trading cultures enables Tickmill to remain both robust and adaptable.

Regulation and Security Measures

Regulation is a critical consideration for any trader entrusting their funds to an online broker. Tickmill operates under several reputable regulatory bodies, which serve to protect client interests and ensure that the firm adheres to high operational standards.

Regulatory Oversight:

- Financial Conduct Authority (FCA) – UK: Tickmill UK Ltd is licensed by one of the world’s most stringent financial regulators. The FCA’s stringent oversight ensures that strict conduct, capital adequacy, and reporting standards are upheld.

- Cyprus Securities and Exchange Commission (CySEC) – EU: Tickmill Europe Ltd is regulated by CySEC, offering protections aligned with the European Union’s MiFID II framework. This ensures investor safeguards, transparent trading conditions, and compliance with anti-money laundering requirements.

- Seychelles Financial Services Authority (FSA): Tickmill Ltd is licensed by the FSA, providing additional jurisdictional coverage. While not as recognized as the FCA, the FSA license still represents a structured regulatory framework.

- Financial Sector Conduct Authority (FSCA): Tickmill is authorized by the FSCA, which fosters a secure and fair trading environment through well-defined rules and industry standards. Under the FSCA’s supervision, Tickmill upholds client protection measures, ensures transparent operations, and adheres to strict compliance guidelines, thereby extending its commitment to offering trustworthy and responsible brokerage services to traders in the region and beyond.

- Dubai Financial Services Authority (DFSA): Tickmill is regulated by the DFSA, a respected authority responsible for overseeing financial services in the Dubai International Financial Centre (DIFC). The DFSA enforces strict regulatory requirements to ensure that financial institutions operate with integrity, transparency, and fairness. Under DFSA oversight, Tickmill adheres to rigorous standards for client fund protection, anti-money laundering (AML) measures, and ethical business practices, making it a trusted choice for traders in the UAE and the wider Middle Eastern region.

Client Fund Protection and Security:

- Segregated Client Accounts: Funds are stored separately from the company’s operational accounts, minimizing the risk of misappropriation.

- Negative Balance Protection: Clients are protected from losing more than their deposited capital, even in cases of extreme market volatility.

- Investor Compensation Schemes (where applicable): Under certain regulators, eligible clients may receive compensation if the broker becomes insolvent.

These layers of regulation and fund protection measures are not merely formalities. They help ensure that clients can focus on trading strategies without constantly worrying about the safety of their capital.

Company Mission, Vision, and Core Values

Behind Tickmill’s operations lies a set of guiding principles aimed at delivering consistent value and maintaining a customer-centric approach. The company’s mission is to offer transparent and efficient brokerage services built on ethical practices, innovation, and a commitment to continuous improvement.

Core Values:

- Client-Centricity: Every innovation, tool, and service Tickmill introduces is intended to enhance the client experience.

- Transparency: The broker maintains clear pricing, straightforward fee structures, and honest communication.

- Reliability: From stable servers to consistent pricing, reliability underpins the entire trading ecosystem at Tickmill.

- Education and Empowerment: By providing educational materials, webinars, and research resources, Tickmill aims to develop informed, confident traders.

These values play a vital role in shaping Tickmill’s policies and strategic decisions, ensuring that it consistently strives to exceed client expectations.

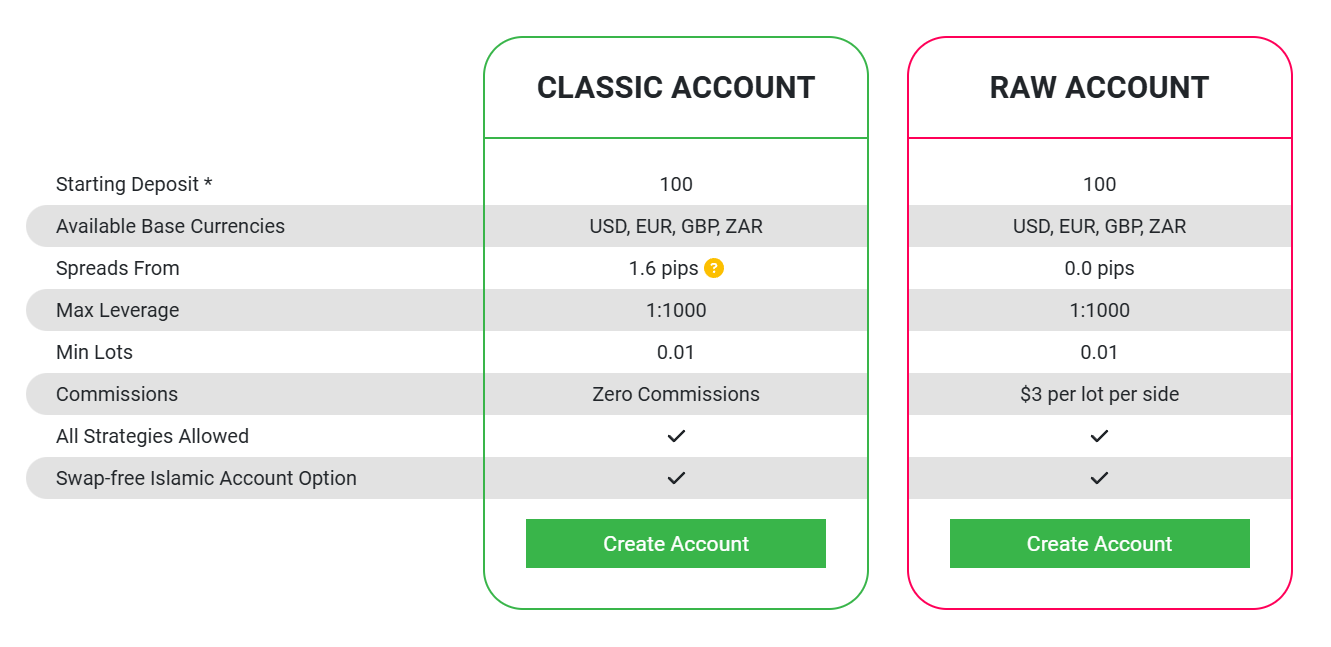

Account Types and Their Benefits

Tickmill caters to a wide spectrum of traders, from absolute beginners to professionals managing large portfolios. Understanding the different account types is essential to finding the one that matches your trading style and objectives.

RAW Account:

Features:

- Extremely tight spreads, starting from 0.0 pips on major currency pairs.

- Commission-based structure with low commissions per lot.

- Minimum deposit as low as $100, making it accessible to a broad range of traders.

Ideal For:

- Scalpers and algorithmic traders who rely on competitive pricing and precise execution.

- Experienced traders who value raw spreads and don’t mind paying a transparent commission.

Classic Account:

Features:

- Spread-only pricing model starting around 1.6 pips with zero commissions.

- Beginner-friendly structure that is easy to understand.

- Minimum deposit requirements are modest, accessible for newcomers.

Ideal For:

- New traders who prefer simplicity and do not want to calculate commissions.

- Those testing strategies or learning the market dynamics at lower capital commitments.

VIP Account:

Features:

- Ultra-tight spreads, often as low as 0.0 pips.

- Reduced commissions that are lower than RAW Account rates.

- Higher minimum deposit, commonly around $50,000 or more, designed for seasoned professionals.

Ideal For:

- High-volume traders, money managers, and institutional clients who prioritize cost-efficiency.

- Traders looking for the most competitive trading conditions available.

Islamic Accounts:

Features:

- Swap-free conditions adhering to Islamic finance principles.

- Suitable for traders who, for religious reasons, cannot receive or pay interest.

Ideal For:

- Clients who require compliance with Shariah law while maintaining access to standard market conditions.

- This robust selection ensures that whether you are a rookie trader dipping your toes into the forex market or an institutional player executing high-volume strategies, Tickmill provides a platform that can grow with your needs.

Trading Platforms

Tickmill offers a variety of trading platforms to cater to traders of all experience levels, preferences, and strategies. Whether you’re a beginner looking for simplicity or an advanced trader requiring sophisticated tools, Tickmill’s platform suite ensures a seamless and reliable trading experience.

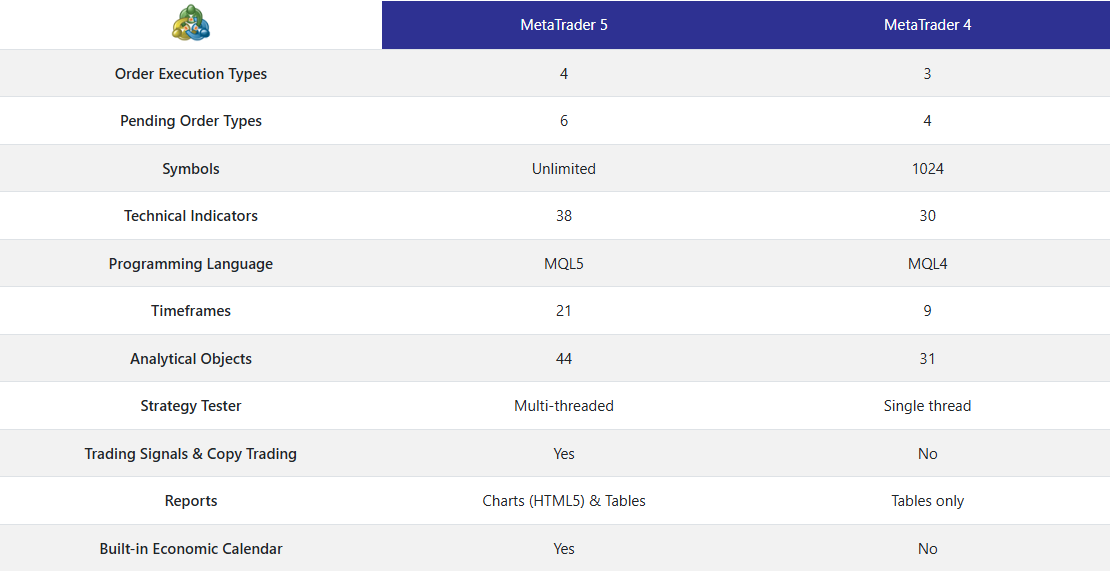

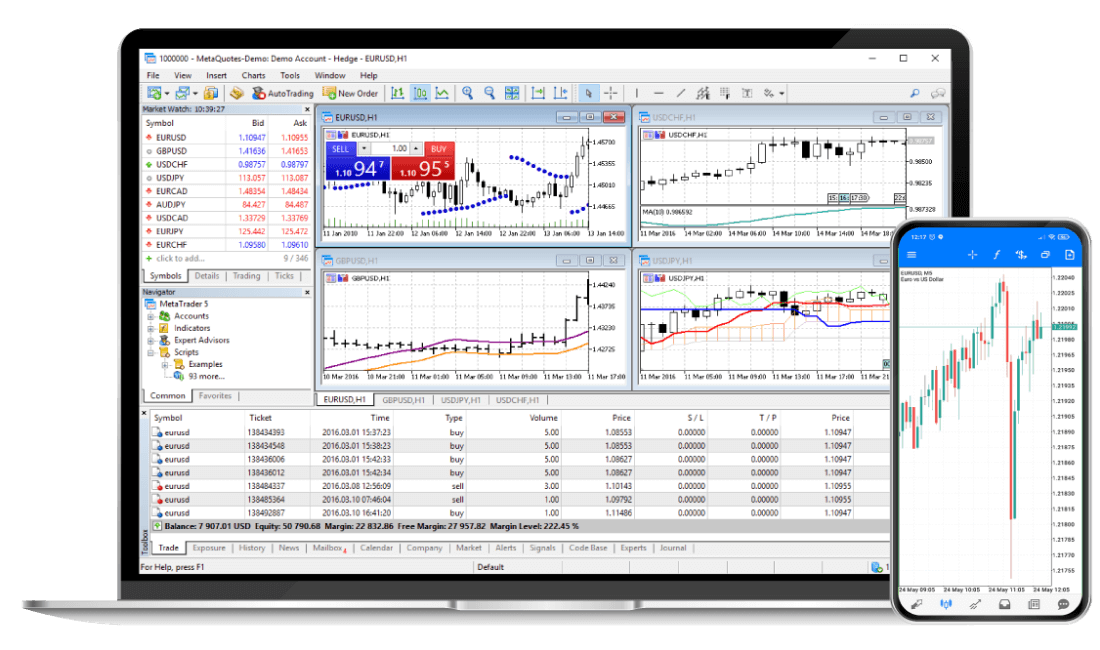

MetaTrader 4 (MT4)

Features:

- Renowned for its intuitive interface and relatively gentle learning curve, making it ideal for novice traders.

- Offers an extensive library of technical indicators, customizable charting tools, and multiple timeframes for precise market analysis.

- Supports automated trading through Expert Advisors (EAs) and MQL4, allowing traders to execute strategies efficiently.

- Equipped with advanced order types, including stop-loss and take-profit levels, for effective risk management.

Benefits:

- A universally recognized platform with a vast global community, ensuring ample resources, tutorials, and third-party tools.

- Ideal for beginners and intermediate traders seeking a robust and reliable platform for forex and CFD trading.

- Customizable layouts and tools tailored to suit individual trading styles.

MetaTrader 5 (MT5)

Features:

- Enhanced features compared to MT4, including market depth data and additional pending order types.

- Offers more timeframes, advanced analytical tools, and a greater variety of built-in indicators.

- Provides faster processing speeds and improved back-testing capabilities for algorithmic traders utilizing the MQL5 language.

- Expands trading options to include multi-asset classes, such as stocks, futures, and commodities (where available).

Benefits:

- Perfect for traders seeking advanced features, more trading instruments, and faster execution speeds.

- Offers unparalleled flexibility for sophisticated trading strategies, including hedging and multi-timeframe analysis.

- Enhanced multi-asset capabilities for traders looking to diversify their portfolios.

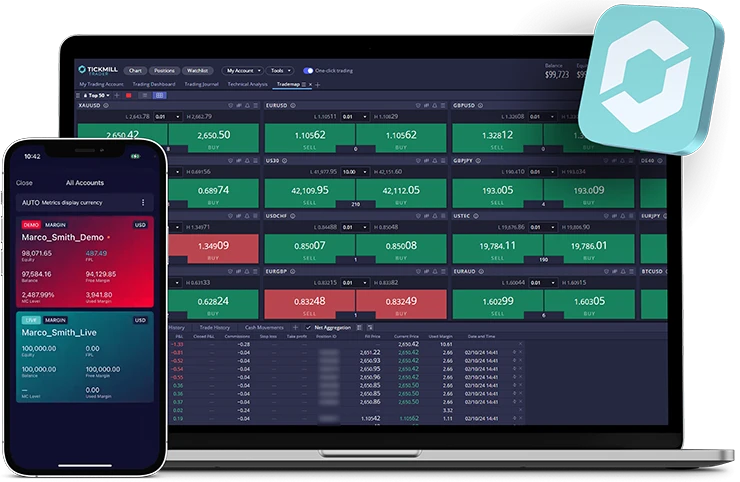

Tickmill Trader (Exclusive Platform)

Features:

- User-Friendly Interface: Tickmill Trader is designed with simplicity and functionality in mind, ensuring a smooth experience for both beginners and experienced traders.

- All-in-One Dashboard: Access real-time market data, execute trades, and monitor performance from one centralized platform.

- Customizable Tools: Features a range of built-in indicators and charting tools tailored to suit your trading strategy.

- Cross-Platform Availability: Accessible via desktop, web, and mobile apps, allowing you to trade seamlessly across devices.

- Integrated Trading Tools: Includes economic calendars, advanced market analysis, and newsfeeds for informed decision-making.

Benefits:

- Exclusive to Tickmill, this platform is optimized for low-latency execution and tailored to the broker’s unique trading environment.

- Provides a streamlined and simplified trading experience with features specifically designed to enhance user productivity.

- Serves as an excellent alternative for traders seeking a proprietary platform that combines advanced tools with simplicity.

Why Choose Tickmill’s Platform Suite?

All three platforms—MetaTrader 4, MetaTrader 5, and Tickmill Trader—are designed to meet the diverse needs of modern traders. Whether you value the community-driven ecosystem of MetaTrader or the exclusivity and tailored experience of Tickmill Trader, you’ll benefit from:

- Cross-Device Compatibility: Trade from anywhere with desktop, web, or mobile access.

- High Reliability: Fast execution and stable performance across all platforms.

- Robust Toolsets: Whether using EAs, advanced analytics, or customizable charts, you’ll find tools to refine your trading strategy.

By offering this versatile platform range, Tickmill ensures that traders of all backgrounds and expertise levels can find the perfect environment to succeed in the financial markets.

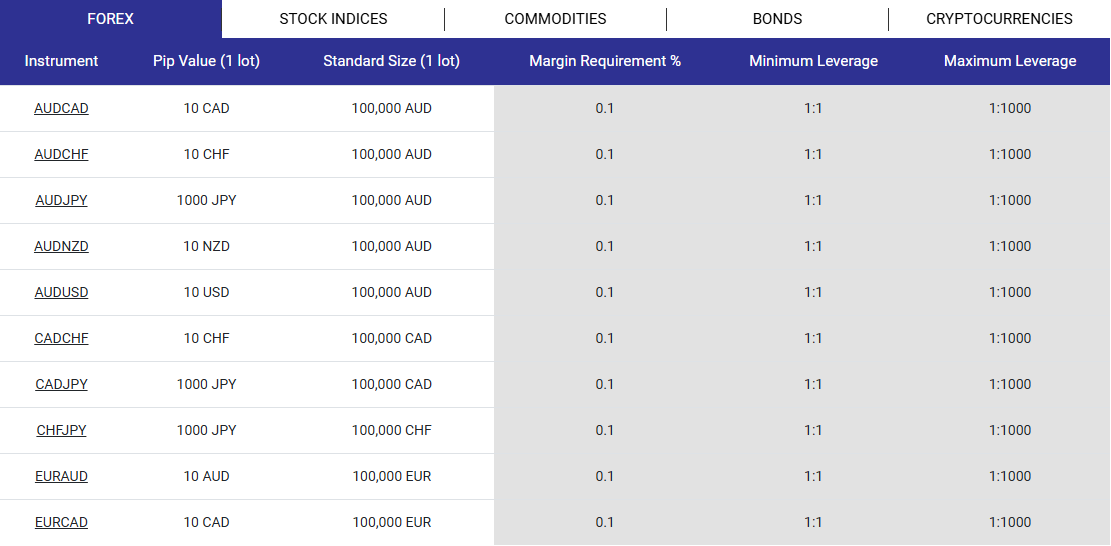

Leverage, Order Types, and Execution Policies

Leverage and order execution capabilities are critical components that shape your trading strategy. At Tickmill, leverage ratios can vary depending on the jurisdiction and regulatory environment you fall under. For clients under stricter regulatory regimes (e.g., FCA), maximum leverage may be capped at 1:30 for major currency pairs. For those trading under other entities, leverage may go higher, up to 1:500 or even beyond, depending on the asset class and local regulations.

Order Types:

- Market Orders: Execute instantly at the current market price.

- Pending Orders: Set future trades at your desired price levels using limit, stop, and stop-limit orders.

- Stop-Loss and Take-Profit Levels: Manage risk and lock in profits by setting predefined exit points.

Execution Policies:

- No Dealing Desk (NDD): Orders are routed directly to liquidity providers, minimizing broker intervention and conflicts of interest.

- Fast Execution Speed: Tickmill uses low-latency servers located in major financial centers, ensuring lightning-fast order fills.

- Slippage Control: Deep liquidity pools help reduce slippage, even during volatile market conditions.

These features allow you to execute your strategies with precision. Whether you’re scalping for a few pips or holding long-term positions, the platform’s flexibility and efficiency help maintain a level playing field.

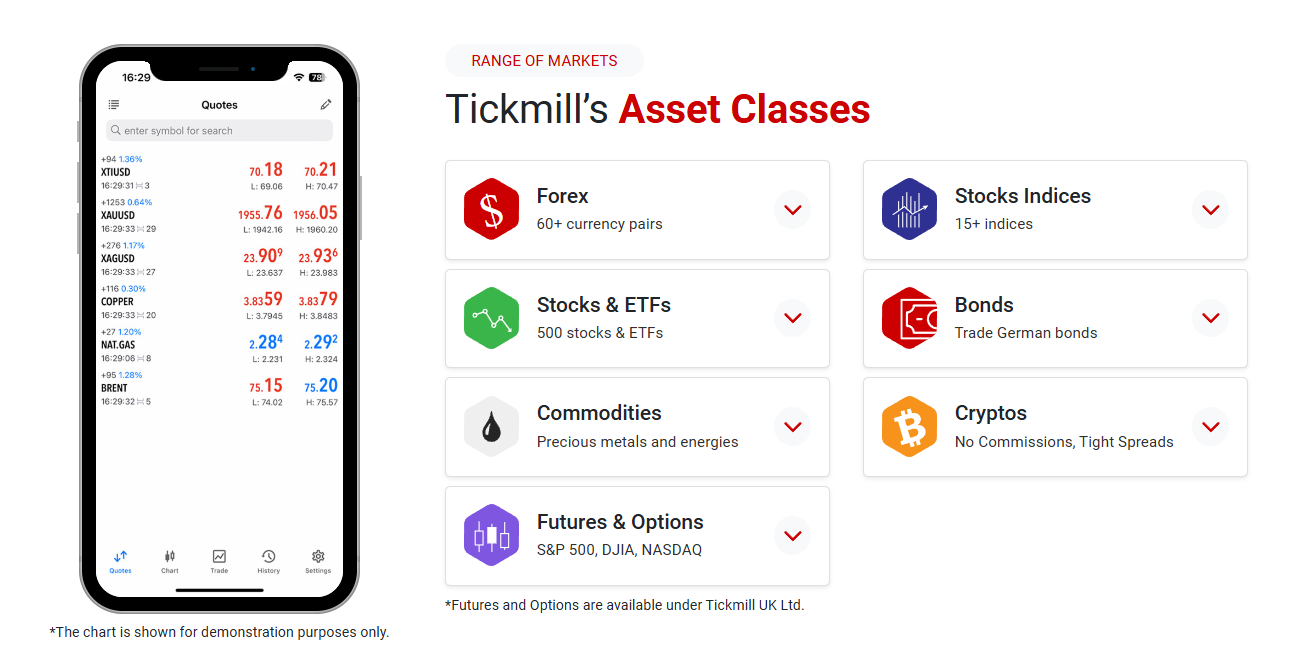

Trading Instruments and Markets Available

Diversification is an essential pillar of modern portfolio management. Tickmill offers a broad range of financial instruments that enable traders to explore global opportunities.

Forex Currency Pairs:

- Over 60 currency pairs, including majors, minors, and exotics.

- Ample liquidity and tight spreads, ideal for day trading and hedging strategies.

Indices and Stocks:

- CFDs on leading global indices like the S&P 500, DAX 40, and FTSE 100.

- Depending on the entity, some traders may gain access to a selection of blue-chip stock CFDs.

Commodities and Metals:

- Precious metals such as Gold and Silver, providing a safe-haven avenue.

- Energy products like WTI and Brent Crude Oil for those interested in macro commodity trends.

Bonds:

- Access to key government bond markets, such as German Bunds, allowing you to implement macroeconomic and interest rate-based strategies.

Cryptocurrencies (Availability May Vary):

- In some jurisdictions, Tickmill may offer popular digital assets like Bitcoin and Ethereum, enabling traders to speculate on this emerging asset class.

This multi-asset environment allows traders to implement complex strategies, hedge exposures, or simply look for new opportunities as markets evolve.

Spreads, Commissions, and Fees

Tickmill is often celebrated for its competitive, transparent, and low-cost pricing structure, making it a go-to choice for cost-sensitive traders.

Spreads:

- RAW and VIP Accounts: Nearly raw spreads starting at 0.0 pips, providing a razor-thin pricing environment especially suited to scalpers and high-frequency traders.

- Classic Accounts: Spreads from around 1.6 pips with no commissions, appealing to those who prefer simplicity and predictability.

Commissions:

- RAW Account: Low commissions, often around $4 per round turn lot on major pairs.

- VIP Account: Even lower commissions, rewarding high-volume and professional traders with substantial cost savings.

Other Fees:

- Swap Rates: Overnight financing costs apply to positions held past the daily rollover. Islamic accounts can opt for a swap-free structure, usually with a small administrative fee.

- Deposit/Withdrawal Fees: Generally free, though certain payment providers may charge their own transaction fees.

By aligning their pricing model with the demands of active and professional traders, Tickmill ensures you retain more of your profits rather than eroding them through unnecessary costs.

Deposits and Withdrawals

The funding process can significantly influence your trading experience. Tickmill streamlines deposits and withdrawals through multiple secure and convenient channels.

Deposit Methods:

- Bank Wires: Although slightly slower, bank transfers are reliable and globally accessible.

- Credit/Debit Cards: Visa and Mastercard options offer near-instant funding.

- E-Wallets (Skrill, Neteller): Fast, often fee-free options for many regions.

- Local Payment Solutions: In certain countries, Tickmill supports local banking systems for seamless transactions.

Withdrawals:

- Requests are generally processed within one working day.

- Withdrawals typically return funds to the original payment method, ensuring a secure and compliant process.

- The absence of broker-imposed withdrawal fees streamlines cost management.

This efficient funding mechanism helps maintain uninterrupted trading activity and easy access to your profits.

Customer Support and Educational Resources

Customer support and knowledge-building resources form the backbone of a trader’s success journey, especially for those new to the markets.

Customer Support:

- Multilingual Assistance: Tickmill’s team speaks multiple languages, catering to a diverse clientele.

- Channels: Email, live chat, and telephone support help address queries promptly.

- Responsiveness: Support teams are known for timely, professional, and solution-oriented interactions.

Educational Resources:

- Webinars and Seminars: Live training sessions cover market analysis, trading strategies, technical indicators, and platform tutorials.

- Tutorial Videos and Guides: Step-by-step instructions on using MT4/MT5, placing orders, and managing risk.

- Market Insights and Economic Calendars: Daily and weekly analyses highlight key trading opportunities and upcoming events that may impact the markets.

- E-books, Blog Posts, and Research Articles: Written resources allow traders to learn at their own pace, covering everything from forex basics to advanced risk management techniques.

For traders looking to improve their skills, Tickmill’s educational ecosystem offers a structured pathway to growth and development.

Trading Tools, Research, and Analysis Features

To gain a competitive edge, traders need cutting-edge analytical tools and reliable research insights. Tickmill integrates several features to meet these demands.

Trading Tools:

- Autochartist (Where Available): A popular pattern recognition tool that identifies trading opportunities across multiple timeframes and asset classes.

- Economic Calendar: Stay informed about economic events, policy announcements, and data releases that drive market volatility.

- Custom Indicators and Add-Ons: Traders can install specialized MT4/MT5 plugins to tailor their analytical environment.

Research and Analysis:

- Daily Market Commentary: Regularly updated to reflect current trends, sentiment shifts, and price action setups.

- Technical and Fundamental Reports: In-depth coverage of markets that helps traders form a well-rounded view.

- Trading Psychology and Strategy Insights: Articles and blog posts guide traders to maintain discipline, manage emotions, and refine their strategies over time.

By offering these resources, Tickmill empowers traders to trade not just with intuition, but with well-informed perspectives rooted in thorough research.

Execution Speed, Reliability, and Latency

In a market where price movements can occur in milliseconds, execution speed and platform stability are essential.

No Dealing Desk Execution:

- Tickmill’s NDD model means the broker does not take the opposite side of your trades. Instead, orders are passed directly to liquidity providers, ensuring a more transparent trading environment.

Low Latency Infrastructure:

- With data centers and servers strategically placed in major financial hubs like London and New York, Tickmill ensures minimal delays between your order and market execution.

- Rapid execution is especially beneficial for scalpers, day traders, and automated strategies that rely on pinpoint accuracy.

Stable and Reliable Systems:

- Redundant server setups and continuous technical monitoring minimize downtime.

- Reliable infrastructure fosters confidence, allowing traders to focus on strategy rather than technical hiccups.

Social Trading and Copy Trading Features

While Tickmill doesn’t heavily market its own proprietary social trading ecosystem, it integrates seamlessly with third-party solutions, allowing clients to follow and replicate successful traders’ strategies.

Integration Options:

- Myfxbook’s AutoTrade: Connect your Tickmill account to Myfxbook, a popular community-driven platform that provides performance-tracking, analysis, and copy trading services.

- MQL5 Community Signals: Within MT4/MT5, you can subscribe to signal providers whose trades will automatically mirror in your account.

These integrations offer flexibility. Traders who lack the time or expertise to analyze the markets independently can still potentially benefit from established strategies vetted by a community of fellow investors.

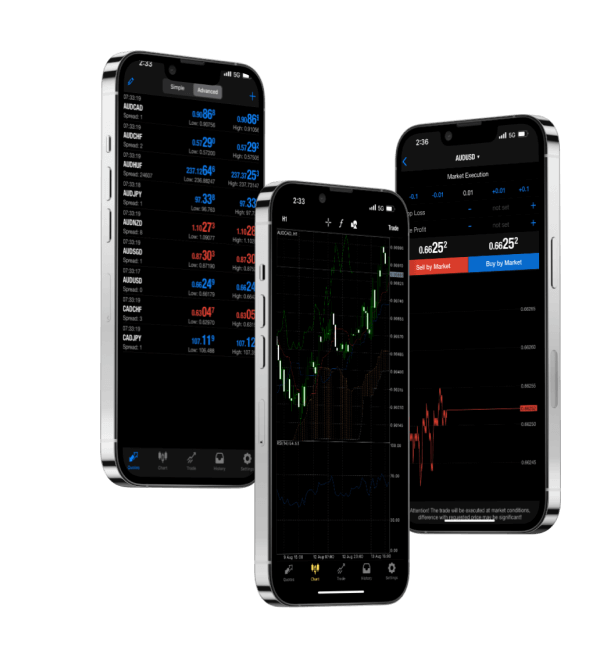

Mobile Trading Experience

As more traders seek to monitor and adjust positions on-the-go, mobile trading capability has become a non-negotiable feature.

MT4 and MT5 Mobile Apps:

Features:

- Real-time quotes, interactive charts, and built-in technical indicators.

- Full order management capabilities, enabling you to open, modify, and close positions remotely.

- Secure login and push notifications ensure you stay informed about account activity and market conditions.

Benefits:

- Mobile trading supports active lifestyles, allowing you to seize opportunities in real-time, even when traveling.

- The user-friendly mobile interface is especially helpful for traders who value flexibility and immediate market access.

Bonus Programs, Promotions, and Competitions

To foster community engagement and reward loyal clients, Tickmill occasionally offers bonuses and competitions.

Common Promotions:

- Trading Contests: Live and demo contests encourage competitive learning environments. Winners may receive cash prizes, rebates, or other incentives.

- Referral Bonuses: Introduce friends or colleagues to Tickmill and earn rewards for each successful referral.

- Seasonal Promotions: From time to time, the broker might offer deposit bonuses, reduced commissions, or cashback programs.

It’s essential to read all bonus terms and conditions. Some promotions come with trading volume requirements or other criteria that may affect your withdrawal capabilities.

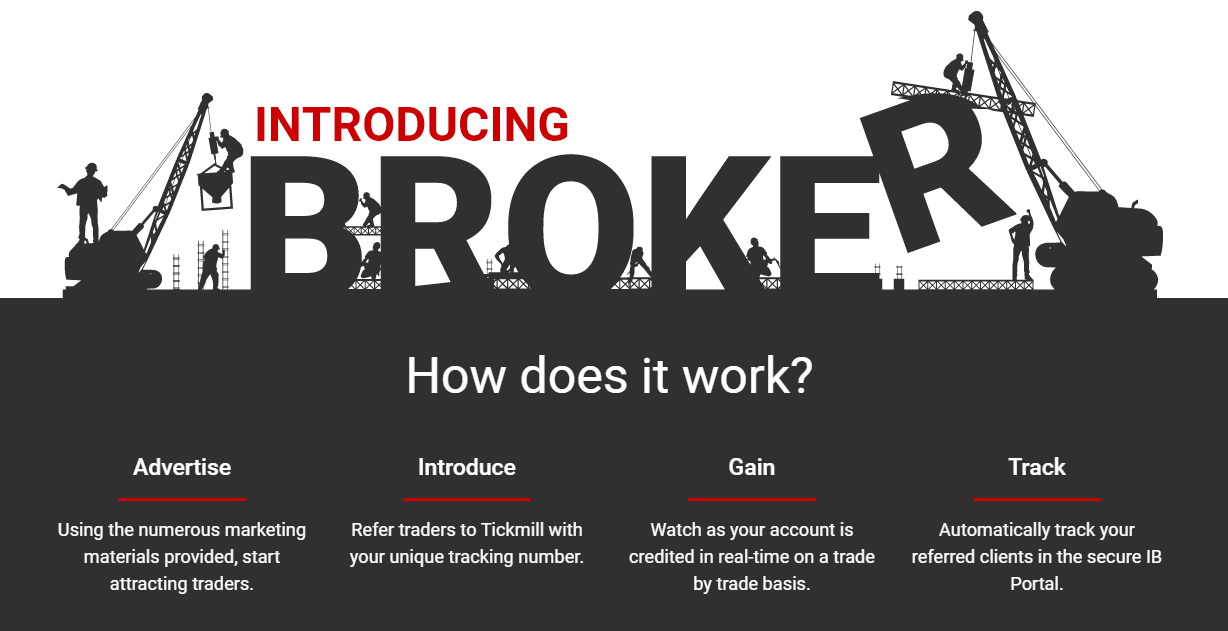

Additional Services: IB and Affiliate Programs

Tickmill extends its offering to Introducing Brokers (IBs) and affiliates, providing opportunities to generate additional income by referring clients.

IB Program:

- Attractive Commissions: IBs earn commissions based on their referred clients’ trading volumes.

- Marketing Support: Access to promotional materials, dedicated account managers, and reporting tools.

- Scalability: As IBs grow their client base, they can negotiate better commission structures and leverage Tickmill’s reputation for client satisfaction.

Affiliate Program:

- Online Monetization: Affiliates can use digital marketing strategies—blogs, social media, SEO—to direct clients to Tickmill.

- Transparent Tracking: Dedicated portals offer real-time analytics and conversion statistics.

- Long-Term Partnership: High-performing affiliates benefit from ongoing support, special deals, and stable revenue streams.

These programs broaden Tickmill’s engagement within the trading community and offer partners a way to monetize their network and expertise.

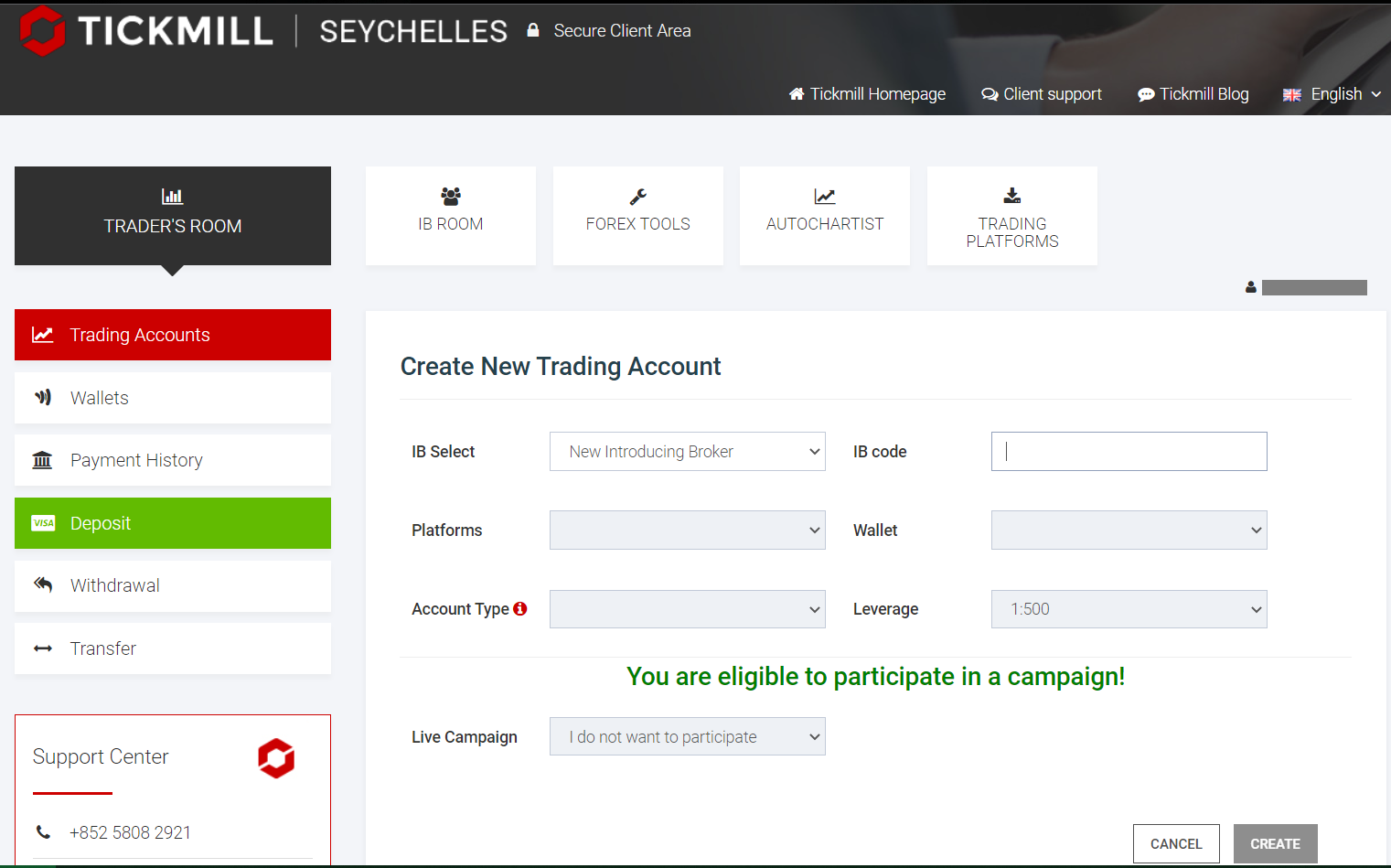

User Experience, Interface Design, and Ease of Use

While Tickmill relies on the MetaTrader ecosystem for its trading infrastructure, the broker’s website, client portal, and overall onboarding process reflect careful attention to user experience.

Website and Portal:

- Clear Navigation: The Tickmill website presents information in a well-structured manner, making it easy to find key data on spreads, regulations, and account types.

- Client Area: Straightforward and intuitive, the client dashboard simplifies tasks such as depositing, withdrawing, accessing statements, and updating account details.

- Educational Content Organization: The resources are logically categorized, ensuring users can quickly access content relevant to their skill level or topic of interest.

This user-focused design helps reduce the learning curve for newcomers and fosters a smooth, frictionless experience for experienced traders.

Risk Management Tools and Strategies

Sound risk management lies at the heart of long-term trading success. Tickmill supports traders in managing their risk exposure through various tools and guidelines.

Risk Management Features:

- Stop-Loss and Take-Profit Orders: Set protective stops and profit targets directly within the platform.

- Position Sizing Calculators: Many traders use third-party or integrated tools to determine correct position sizes based on account equity and acceptable risk levels.

- Hedging Capabilities: Both MT4 and MT5 support hedging strategies, allowing you to offset positions and reduce net exposure in volatile markets.

- Negative Balance Protection: Ensures you never owe more than your deposited capital.

By combining these tools with the extensive educational material on risk management techniques, Tickmill encourages responsible and informed trading behaviors.

Pros and Cons of Tickmill

Pros:

- Competitive Pricing: Ultra-low spreads, minimal commissions, and transparent fee structures.

- Robust Regulation: Oversight by FCA, CySEC, and others ensures client fund safety and compliance.

- Versatile Platforms: MT4 and MT5 cater to both beginners and advanced traders.

- Diverse Markets: Forex, indices, commodities, metals, and bonds available from a single account.

- Educational and Analytical Support: High-quality webinars, analysis, and trading tools enhance trader decision-making.

Cons:

- Lack of Proprietary Platform: While MT4 and MT5 are industry standards, some traders may desire a proprietary platform with unique features.

- High Minimum for VIP Account: Access to the most competitive conditions requires substantial initial capital.

- Limited On-Platform Social Trading: Social trading relies on third-party integrations rather than built-in solutions.

Comparison with Other Brokers

Tickmill vs IC Markets:

- Both offer low spreads and ECN-like execution.

- Tickmill often matches or slightly betters IC Markets in commissions, appealing to cost-conscious traders.

- IC Markets may provide a broader selection of instruments, but Tickmill’s research and educational focus stands out.

Tickmill vs FXTM:

- FXTM is known for varied account types and promotions.

- Tickmill beats FXTM on cost structure and transparency, which appeals to traders focused on long-term profitability.

- While FXTM excels in localized offerings, Tickmill maintains a cleaner, more straightforward pricing model.

Tickmill vs XM:

- XM shines in educational content and promotions.

- Tickmill, however, has an edge in spreads and execution quality.

- Traders who value analytical depth and raw pricing lean toward Tickmill, whereas those seeking more frequent promos might prefer XM.

Who is Tickmill Best Suited For?

Ideal Candidates:

- Scalpers and Day Traders: Low spreads, fast execution, and no restrictions on strategies make Tickmill optimal for short-term players.

- Algorithmic Traders: Full compatibility with EAs, no dealing desk execution, and robust infrastructure support automated trading systems.

- Cost-Conscious Traders: Tighter spreads, lower commissions, and minimal additional fees preserve trading profits.

- Intermediate to Advanced Traders: Experienced market participants who appreciate reliable execution and transparent pricing find Tickmill appealing.

May Not Suit:

- Brand-New Traders Seeking Microcent Accounts: While beginners can start with a Classic Account, those wanting ultra-micro lots or a highly hand-holding environment may find other brokers more tailored to their needs.

- Social Traders Wanting Integrated Solutions: Tickmill relies on external platforms for copy trading, which may deter those looking for a built-in social ecosystem.

Tips for Getting Started with Tickmill

If you’re contemplating opening an account with Tickmill, consider these steps:

- Define Your Trading Goals: Determine whether you’re a scalper, swing trader, or long-term investor. Match your strategy to the appropriate account type (Pro, Classic, or VIP).

- Start with a Demo Account: Before risking real capital, get accustomed to the platform’s features, test your strategies, and understand the broker’s execution quality.

- Leverage Educational Resources: Read blog posts, attend webinars, and review market analyses to enhance your trading knowledge and approach.

- Experiment with Order Types and Tools: Practice using limit orders, stop orders, and risk management tools to become a more disciplined trader.

- Gradually Scale Up: Begin with a modest deposit, refine your strategy, and increase your capital only after you’ve established confidence and consistency.

Following these steps ensures a smoother onboarding process and enhances your likelihood of long-term success.

Final Verdict and Conclusion

Tickmill distinguishes itself as a regulated, transparent, and trader-focused broker that offers compelling value. Between its low costs, stable execution environment, and wealth of educational and analytical resources, it provides traders with a fertile ground to hone their strategies, refine their skills, and strive for sustainable profitability.

From beginners looking for a fair and simple introduction to the forex market to veterans demanding top-tier execution and institutional-grade spreads, Tickmill caters to a wide audience. The broker’s alignment with regulatory standards, a client-centric approach, and continuous innovation in technology and education all combine to form a robust trading ecosystem.

While it may not offer a proprietary social trading platform or the broadest range of promotions in the industry, Tickmill compensates with rock-solid trading conditions, trustworthiness, and a long-term commitment to its clients’ success. Ultimately, if low spreads, fast execution, and reliable regulation are at the top of your wishlist, Tickmill deserves a prominent spot on your shortlist of potential brokers.

How Does FXCracked Review Work?

At FXCracked, our commitment to a readers-first policy prioritizes your safety and trust above all. We go beyond just examining a brokerage platform’s headline claims; we delve into the smallest details. This meticulous approach reflects our core values of truth and transparency, ensuring that everything we publish upholds the trust our readers place in us. This trust has been instrumental in building our reputation and driving our ongoing growth.

To deliver reliable and comprehensive reviews, we thoroughly examine every aspect of a broker’s business history, reputation, and operations. This diligent process allows us to present our audience with a clear and accurate overview of each brokerage firm.