The world of online trading has grown at an unprecedented rate, especially in the last decade. As retail investors become more aware of forex and CFD (Contract for Difference) trading, the number of brokers has also surged. Within this competitive landscape stands FXTM (ForexTime), a brokerage that has garnered attention from both newcomers and experienced traders.

In this review, we’ll take a close look at FXTM. You’ll get to know its background, how it’s regulated, the trading platforms it offers, account options, fees, and other key details to help you figure out if it’s a broker you can trust.

Table of Contents

FXTM: An Overview and Brief History

Founded in 2011, FXTM quickly established itself as a player to watch in the retail forex and CFD market. It entered the industry at a time when online brokerage services were becoming more accessible worldwide, aided by the internet’s global reach.

Key historical points:

- Initial Vision: FXTM sought to provide straightforward and transparent trading experiences, offering accounts that catered to different levels of trading expertise.

- Rapid Growth: Through focused marketing, cutting-edge technology, and robust regulatory measures, FXTM expanded into multiple regions within a few years of its launch.

- Industry Recognition: Over time, FXTM picked up awards for areas like customer service, education, and general brokerage services. These accolades helped solidify its standing among both novice and seasoned traders.

Despite its relatively short history, FXTM managed to develop robust regulatory partnerships, which significantly boosted its reputation. In a field often fraught with scammers and poorly regulated entities, having reputable licenses is essential for building credibility and trust.

Regulation and Licensing

Regulation is one of the first things experienced traders look at when assessing a broker’s credibility. A robust regulatory environment offers greater protections such as fund segregation, negative balance protection, and regular audits.

FXTM operates under several entities belonging to the overarching Exinity Group. Below are key regulatory bodies under which these entities are licensed or authorized:

Financial Conduct Authority (FCA), UK

- Arguably one of the most respected financial regulators globally.

- Brokers regulated by the FCA must adhere to stringent rules surrounding client fund safety and transparency.

- FXTM’s affiliation with the FCA covers certain regions, particularly the UK and some EU scenarios (though Brexit has changed some dynamics).

Financial Services Commission (FSC), Mauritius

- Exinity Limited (operating as FXTM in certain regions) is licensed by the FSC in Mauritius.

- This license allows the company to serve international clients while maintaining oversight from an official regulatory body.

Capital Markets Authority (CMA), Kenya

- FXTM also holds a Non-Dealing Online Foreign Exchange Broker license under the CMA in Kenya.

- This reflects the broker’s push into the African continent, offering localized services to a rapidly growing market of traders.

Former Cyprus Securities and Exchange Commission (CySEC) License

- FXTM was previously licensed under CySEC for European operations.

- In May 2024, however, they voluntarily relinquished this license, indicating a strategic shift in regulatory affiliations. This move may also reflect changes in how FXTM prefers to structure its operations.

What Regulation Means for You

Traders seeking accountability and safety can find reassurance in the fact that a multi-regulated broker faces ongoing compliance checks. Typically, regulated brokers separate client funds from operational funds, lowering risks if the company faces financial issues. Additionally, they must follow fair dealing practices, which mitigate the likelihood of unscrupulous behavior.

FXTM’s Global Reach and Strategic Regulatory Shifts

The online trading sphere is incredibly competitive, with many brokers offering similar services. What differentiates FXTM is its global footprint across continents:

- Europe and the UK: Previously supported through Cyprus (CySEC) and still partially supported via the FCA.

- Africa: Strong local presence in Nigeria, Kenya, and South Africa, among others. The CMA license in Kenya shows an intent to keep a firm foot in Africa.

- Asia and Beyond: With the Mauritius license, FXTM can service Asian markets, along with Latin America, the Middle East, and other emerging economies.

Voluntary Relinquishment of CySEC License

While the cessation of the CySEC license may appear concerning at a glance, it was a voluntary decision. The rationale could range from cost considerations to internal restructuring or focusing on other licenses that provide broader operational freedom. Nonetheless, it is crucial for you, as a potential client, to verify which entity will handle your account and under which regulations you will be protected.

Trading Platforms and Tools

Having robust, user-friendly, and technologically advanced trading platforms is a must in today’s online trading environment. FXTM meets this requirement by offering:

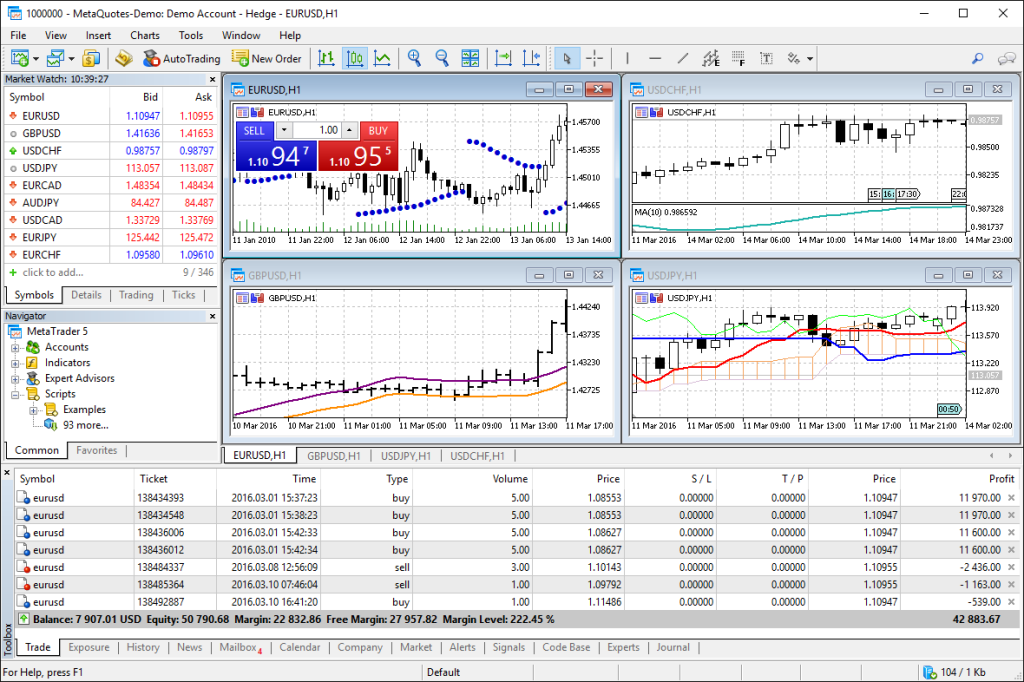

MetaTrader 4 (MT4)

Why MT4?: Launched in 2005, MetaTrader 4 has become a standard in the industry because of its stability and ease of use.

Features:

- Multiple chart types (line, bar, candlestick)

- A wide selection of technical indicators (Moving Averages, Stochastic Oscillator, etc.)

- Expert Advisors (EAs) for automated trading strategies

- One-click trading and swift execution

Who It’s For: Beginner to intermediate traders often start with MT4 due to its user-friendly environment.

MetaTrader 5 (MT5)

Advanced Successor: MT5 offers a more extensive range of trading tools, timeframes, and indicators than MT4.

Key Advantages:

- Additional order types (Buy Stop Limit, Sell Stop Limit)

- More technical indicators built-in

- Integrated economic calendar

- Option for hedging or netting positions

Who It’s For: Typically appeals to traders who want to trade not just forex but also stocks, commodities, and futures from one platform. MT5 can be advantageous if you’re looking for expanded analysis tools.

FXTM Trader App

Mobile Convenience: The FXTM Trader App aims to provide an all-in-one mobile solution.

Highlights:

- Real-time quotes and price alerts

- Simplified interface to open/close trades quickly

- Account management (view balance, deposit, withdraw)

- Charting features designed for smaller screens

Why It Matters: With mobile trading on the rise, brokers that offer proprietary apps with smooth user experience often stand out in a crowded marketplace.

Additional Tools and Features

- Virtual Private Server (VPS): Traders needing uninterrupted connectivity for automated trading (EAs) can subscribe to a VPS service.

- Copy Trading: Depending on your region, FXTM may provide a social trading platform where novices can follow and replicate trades from more experienced traders.

- MetaTrader WebTrader: A browser-based MT4/MT5 solution for those who can’t or prefer not to install software on their devices.

Account Types and Trading Conditions

FXTM tailors its account types to serve different trading profiles. Whether you’re a complete beginner or an advanced, high-frequency trader, there’s likely a suitable option.

Micro Account

- Minimum Deposit: Typically $10 (could vary by region or promotion).

- Lot Sizes: Starts from micro-lots (0.01), enabling more controlled risk.

- Spreads: Often slightly higher compared to the Advantage accounts, but still competitive for a micro setup.

- Who It Suits:

- Beginner traders looking to learn without risking a large sum.

- Those testing new strategies in a live environment but with minimized capital exposure.

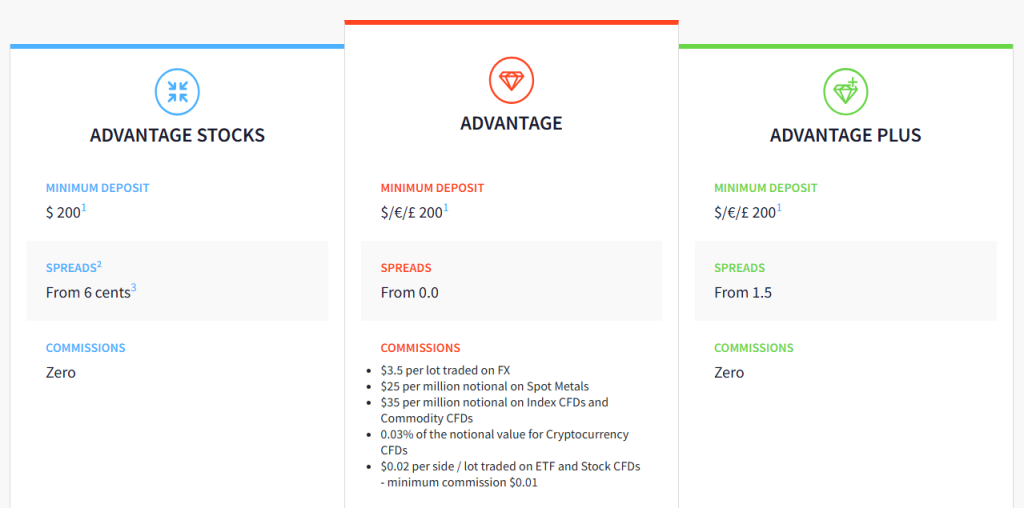

Advantage Account

- Minimum Deposit: Around $500.

- Spreads: Can start from 0.0 pips on major currency pairs.

- Commission: Typically, a small commission per lot is charged (e.g., $4 per standard lot round turn, though this can vary).

- Why It Stands Out:

- Tight spreads especially appealing to scalpers or high-volume traders.

- More cost-effective if you’re trading large positions regularly.

Advantage Plus Account

- Minimum Deposit: Often $500, subject to promotional variations.

- Spreads: Slightly wider than the raw spread found in the Advantage Account, but with zero commissions.

- Ideal Traders:

- Those preferring a simplified cost structure without needing to calculate commissions.

- Swing or position traders who make fewer trades but hold positions for longer periods.

Comparing the Three Main Account Types

| Feature | Micro | Advantage | Advantage Plus |

|---|---|---|---|

| Minimum Deposit | Low ($10) | Moderate ($500) | Moderate ($500) |

| Spreads vs. Commission | Wider spreads, no commission | Tight spreads, commission-based | Zero commissions, moderate spreads |

| Trading Style Fit | Learning, small-scale, or budget trading | High-frequency, scalping, or more advanced strategies | Straightforward cost structure, potentially better for mid-to-long-term trading holds |

Tradable Instruments

A broker’s breadth of instruments can significantly impact how you diversify and manage risk. FXTM covers a wide spectrum:

Forex

- Currency Pairs: Over 60 pairs, including major, minor, and exotic pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/ZAR.

- Market Liquidity: Major pairs offer deep liquidity, often resulting in tighter spreads. Exotic pairs can have more volatility and wider spreads.

- Leverage: Varies depending on regulatory jurisdiction. In some regions, leverage can go as high as 1:1000, while in more strictly regulated areas, it might be capped at 1:30 or 1:50.

Commodities

- Precious Metals: Gold and silver are common offerings, often traded against the U.S. dollar (XAU/USD, XAG/USD).

- Energy: Crude oil (WTI, Brent) and natural gas.

- Why Trade Commodities?: Often used as hedges against inflation or as a diversification tool in a forex-heavy portfolio.

Indices

- Examples: S&P 500 (US), NASDAQ (US), FTSE 100 (UK), DAX 40 (Germany), and more.

- Index CFDs: Allows traders to speculate on the performance of a basket of stocks from a specific region or sector.

Shares

- CFDs on Stocks: Popular U.S., European, and UK-listed companies. Examples include Apple, Tesla, Amazon, and others, depending on local availability.

- Benefit: Traders can profit from rising or falling prices without actually owning the underlying asset. Short-selling is often easier than in traditional stock markets.

Cryptocurrencies

- Digital Assets: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), etc.

- Volatility Consideration: Crypto prices can swing wildly within short time spans, presenting both opportunities and risks.

- Regulatory Nuances: Availability depends on regional regulations. Some jurisdictions have stricter rules regarding crypto CFDs.

Spreads, Fees, and Commissions

Transparent cost structures often differentiate a good broker from a mediocre one. Here’s how costs typically work at FXTM:

Spreads: The difference between the bid (sell) and ask (buy) price.

- Variable: For advantage-type accounts, spreads can start from 0.0 pips. For micro accounts, spreads are generally higher but still competitive in many cases.

Commissions:

- Advantage Account: A commission is charged per lot, typically depending on your monthly trading volume.

- Advantage Plus: Zero commissions but slightly higher spreads.

Swap/Overnight Fees:

- If you hold positions past the market’s daily close, you may pay or earn swap fees.

- Swap rates depend on interest rate differentials between currencies.

Inactivity Fees:

- FXTM may charge an inactivity fee if your account remains dormant for an extended period. Check their official documentation for up-to-date specifics.

Deposit/Withdrawal Fees:

- Many deposit methods are free, though some e-wallets or payment processors might incur a small fee.

- Withdrawals can be subject to bank or third-party processing costs.

Cost Example: You open a 1 standard lot position on the EUR/USD in an Advantage Account with a 0.2 pip spread and $4 commission per round turn. If you quickly scalp and exit with a 5 pip gain, your profit must cover the spread and the $4 commission to net a positive result.

Deposits and Withdrawals

A broker’s payment infrastructure can greatly influence user experience. FXTM generally provides:

- Bank Wires: Traditional method, good for large sums, but can take a few business days to process.

- Credit/Debit Cards: Usually faster deposits. Withdrawals might be processed back to the same card.

- E-Wallets: Skrill, Neteller, and other e-wallets often offer near-instant deposits and relatively quick withdrawals.

- Local Payment Methods: In certain countries, FXTM supports region-specific banking solutions to expedite transfers in local currencies.

Processing Times

- Deposits: Can be instantaneous via e-wallets or cards, but bank wires may take 2–5 business days.

- Withdrawals: Typically between 24 hours and 5 business days, depending on the method. Some users may experience additional KYC checks or bank-related delays.

KYC and Verification

Ensure that your account is fully verified with identification documents (passport, driver’s license) and proof of address (utility bill, bank statement). Unverified or partially verified accounts could lead to withdrawal delays.

Educational Resources and Market Analysis

One of FXTM’s strong suits is educational support. New traders, especially, appreciate the structured learning paths:

- Webinars and Seminars:

- Often hosted by industry veterans.

- Topics range from the basics of forex to advanced technical and fundamental analysis.

- Tutorials and Articles:

- Step-by-step guides on how to use MT4/MT5, place trades, and understand market movements.

- Articles demystifying chart patterns (e.g., head and shoulders, double bottoms) or economic indicators (e.g., Non-Farm Payrolls).

- Daily Market Updates:

- FXTM’s in-house analysts provide daily or weekly commentary on market developments, economic events, and asset price forecasts.

- Economic Calendar:

- Integrated tool highlighting upcoming macroeconomic releases such as GDP reports, inflation data, central bank announcements, etc.

- Traders can gauge market volatility by tracking these events.

Why Education Matters

Forex and CFD markets can be highly volatile. Having a solid foundation in fundamental and technical analysis can reduce mistakes often made by beginners. Additionally, advanced knowledge (e.g., risk management strategies, portfolio diversification) can help more experienced traders refine their approaches.

Customer Support

Customer service can make or break your trading experience, particularly when timely problem resolution is needed. FXTM aims to offer:

- Live Chat: Accessible directly on their website or the FXTM Trader App for immediate queries.

- Email Support: Separate emails for general inquiries, compliance, and technical issues.

- Phone Support: Regional phone numbers are available, which can be a major benefit if you prefer direct conversation.

- Multilingual Assistance: Given FXTM’s global reach, support is offered in multiple languages, such as English, French, Arabic, etc.

Support Hours

Some regulatory restrictions may dictate that support is offered 24/5 rather than 24/7. Response times can be longer during peak trading hours or major market events (e.g., central bank announcements).

User Feedback and Reviews

Traders often look for users reviews to understand real experiences. Here is a concise breakdown of general sentiments:

- Positive User Experiences:

- Educational Materials: Beginners appreciate the webinars, articles, and overall guidance.

- Competitive Spreads and Account Options: Advantage Account’s tight spreads are frequently cited as a key advantage.

- Regulatory Oversight: Being governed by notable regulators boosts trust and credibility.

- Negative User Experiences:

- Withdrawal Delays: Some traders reported longer-than-expected withdrawal times. However, this can also happen due to incomplete documentation or banking networks.

- Customer Service Responsiveness: Although generally rated well, a few users mention slower replies during high traffic hours.

How to Interpret Reviews

Keep in mind that reviews can be subjective, often influenced by a user’s trading performance or personal circumstances. It’s always wise to cross-check multiple sources—forums, social media, reputable broker review sites—before making a judgment.

FXTM’s Pros and Cons

Pros

- Robust Regulation: Oversight by the FCA (UK), FSC (Mauritius), and CMA (Kenya).

- Multiple Account Types: Micro, Advantage, and Advantage Plus cater to a variety of trading needs.

- User-Friendly Platforms: MT4, MT5, and a proprietary mobile app.

- Strong Educational Resources: A broad range of webinars, tutorials, and daily market analysis.

- Global Accessibility: Local payment options and localized support in many regions.

Cons

- Withdrawal Processing Times: Some users face occasional delays.

- Mixed Customer Service Feedback: While often prompt, wait times can increase during volatile market periods.

- Voluntary Relinquishment of CySEC License: Could raise questions for some EU-based traders, although the broker remains regulated elsewhere.

Security Measures and Risk Management

Because trading inherently carries risk, security—both in a technological and financial sense—is paramount:

- Negative Balance Protection: This ensures your account balance doesn’t go below zero due to dramatic market movements, especially important during black swan events.

- Segregated Client Funds: Regulated brokers must keep client funds in separate accounts to protect them if the broker faces liquidity issues.

- SSL Encryption: Personal and financial data on FXTM’s website and trading platforms are secured through encryption protocols.

- Risk Management Tools: Stop-loss orders, trailing stops, and limit orders help to manage open positions and control potential losses.

Market Volatility Example

Imagine a scenario where a major economic announcement (like a central bank surprise rate hike) causes a rapid market gap. Negative balance protection prevents your account from dipping into a large negative if your stop-loss is bypassed by the gap, protecting you from owing more than you deposited.

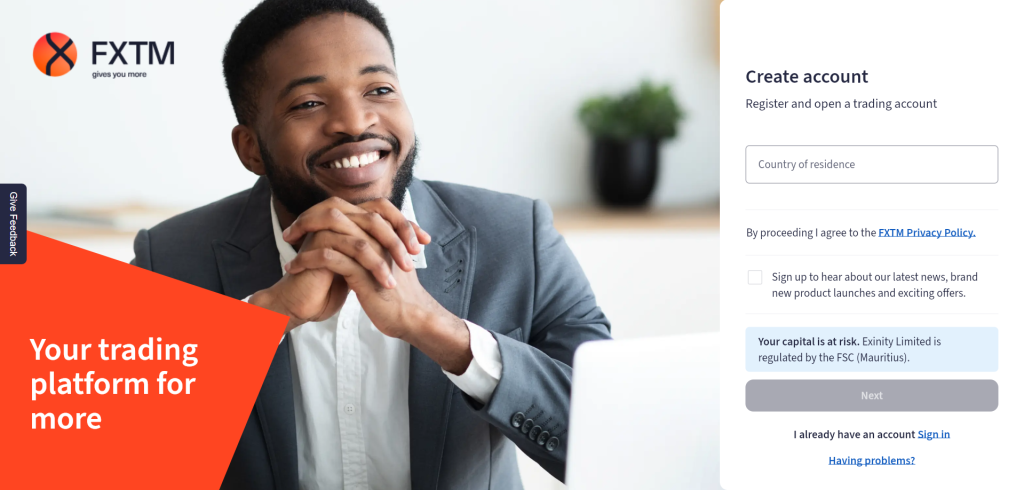

Opening an Account with FXTM

If you decide FXTM aligns with your trading objectives, opening an account generally follows these steps:

- Visit FXTM’s Official Website: Look for the “Open Account” or “Register” button.

- Sign-Up Form: Provide your name, email, phone number, and create a secure password.

- Select a Jurisdiction: Depending on your location, you’ll be placed under a specific regulatory entity.

- Account Confirmation: Check your email for a verification link or code.

- KYC and Verification: Upload proof of identity (ID, passport, or driver’s license) and proof of address (utility bill, bank statement).

- Choose Account Type: Decide between Micro, Advantage, or Advantage Plus—based on your experience and capital.

- Fund Your Account: Deposit via the available methods (card, bank transfer, e-wallet, etc.).

- Start Trading: Once the funds appear in your account, you can access MT4, MT5, or the FXTM Trader App to place your first trades.

Tips

- Double-check your personal details to match the documents you upload. Any discrepancies (misspelling of names, outdated address) can lead to verification delays.

- Become familiar with the client dashboard, where you can see your transaction history, open new subaccounts, or access educational material.

Who Should Consider FXTM?

- Absolute Beginners: The Micro Account has a very low minimum deposit (around $10), making it ideal for those who want to explore live markets without committing large funds.

- Experienced Traders: Advantage and Advantage Plus accounts offer tight spreads or no-commission models, appealing to scalpers, day traders, and swing traders.

- Education-Driven Individuals: FXTM’s educational resources (webinars, tutorials) can be crucial if you value continuous learning.

- Global Traders: Multiple payment methods and multilingual support make FXTM an attractive choice for traders from various regions.

- Mobile-First Users: If you prefer the convenience of a mobile app, FXTM’s proprietary Trader App offers advanced functionalities on the go.

Tips and Best Practices for New Traders

Venturing into the forex and CFD markets can be exciting but challenging. Here are some guidelines:

- Leverage Management: High leverage amplifies both gains and losses. If you’re new, consider trading with lower leverage (like 1:10 or 1:30) until you gain confidence.

- Risk-Reward Ratio: Aim for trades that offer at least a 1:2 risk-reward ratio (e.g., risking $50 to gain $100).

- Stop-Loss Orders: Always place a stop-loss to limit potential losses. Emotional decision-making in volatile markets often leads to negative outcomes.

- Position Sizing: Never risk more than 1–2% of your account on a single trade, especially if you’re learning.

- Demo Account First: Before trading real money, practice on a demo account to understand platform features and test strategies.

- Stay Updated: Follow an economic calendar and keep abreast of major news events impacting your trading instruments.

- Avoid Overtrading: Taking too many positions can spread you too thin, both mentally and capital-wise. Focus on quality setups over quantity.

Frequently Asked Questions (FAQs)

Q1: Is FXTM safe and reliable?

A: FXTM is regulated by reputable authorities, including the FCA in the UK, the FSC in Mauritius, and the CMA in Kenya. These regulatory bodies enforce rules on client fund safety and operational transparency, adding layers of security.

Q2: What is the difference between the Advantage and Advantage Plus accounts?

Advantage: Raw spreads starting from 0.0 pips, but there is a per-lot commission.

Advantage Plus: Commission-free trading, but with slightly higher spreads.

Q3: Do I need a large capital to start trading with FXTM?

A: No. The Micro Account typically has a minimum deposit of only $10, making it accessible for those with a modest budget or wanting to start small.

Q4: Are there any bonuses or promotions offered by FXTM?

A: It depends on your region due to varying regulations. Check the broker’s promotions page or contact customer support to see what is currently available in your jurisdiction.

Q5: How can I withdraw my funds from FXTM?

A: Withdrawals can be made via bank wire, credit/debit cards, or e-wallets, among other methods. Processing times vary, typically from instant (for some e-wallets) up to several business days (for banks).

Q6: Can I trade cryptocurrencies on FXTM?

A: Yes, FXTM offers CFD trading on popular cryptocurrencies like Bitcoin, Ethereum, and others. Availability depends on your region’s regulations.

Q7: What happens if I can’t verify my account right away?

A: Unverified accounts usually have restrictions on deposits, withdrawals, or maximum leverage. It’s recommended to complete the KYC process as soon as possible for a smoother trading experience.

Conclusion and Final Thoughts

In a crowded market of online brokers, FXTM (ForexTime) distinguishes itself through strong regulation, a variety of account types, and robust educational offerings. Its presence in multiple jurisdictions ensures that traders from different parts of the world have access to localized payment methods and region-specific customer support.

Strengths:

- Well-Regulated: FCA, FSC, CMA oversight.

- Flexible Account Options: Micro for beginners, Advantage for scalpers, Advantage Plus for no-commission enthusiasts.

- Educational Content: Webinars, daily analyses, extensive tutorials.

- Mobile App: The FXTM Trader App can be a game-changer for those who value on-the-go trading.

Areas to Note:

- Withdrawal Delays: Some clients have reported slower withdrawal times, which may require verification or processing by banking institutions.

- Customer Service Variability: Most experience positive support, but peak trading hours can sometimes stretch response times.

Overall, FXTM is a strong candidate for both new and advanced traders seeking reliability, competitive spreads, and a rich educational environment. As with any broker, it’s essential to research thoroughly, confirm regulations in your location, and start trading with capital you can afford to risk.